Rebuilding Audience Precision with Payment Insights

The digital advertising ecosystem is entering a decisive new phase. As traditional identifiers continue to disappear and addressability declines, advertisers risk losing the precision they once relied on to reach the right audiences at scale.

Today, half of advertising opportunities on the open web are already unaddressable 1, reflecting growing consumer expectations around privacy. In connected TV, the challenge is even more acute. Nearly 70% of ad impressions lack even basic content signals 2, severely limiting advertisers’ ability to understand and activate audiences. This shift goes beyond technology. Consumers still expect relevance but not at the cost of privacy, and media consumption is fragmenting across devices and environments. As ID-based solutions lose effectiveness, advertisers need approaches that restore consistency in audience understanding while reducing operational complexity.

In this context, rebuilding audience precision increasingly requires connecting online signals with responsible, real-world insights. Aggregated payment insights from Mastercard bring a privacy-first, deterministic perspective into audience strategies.

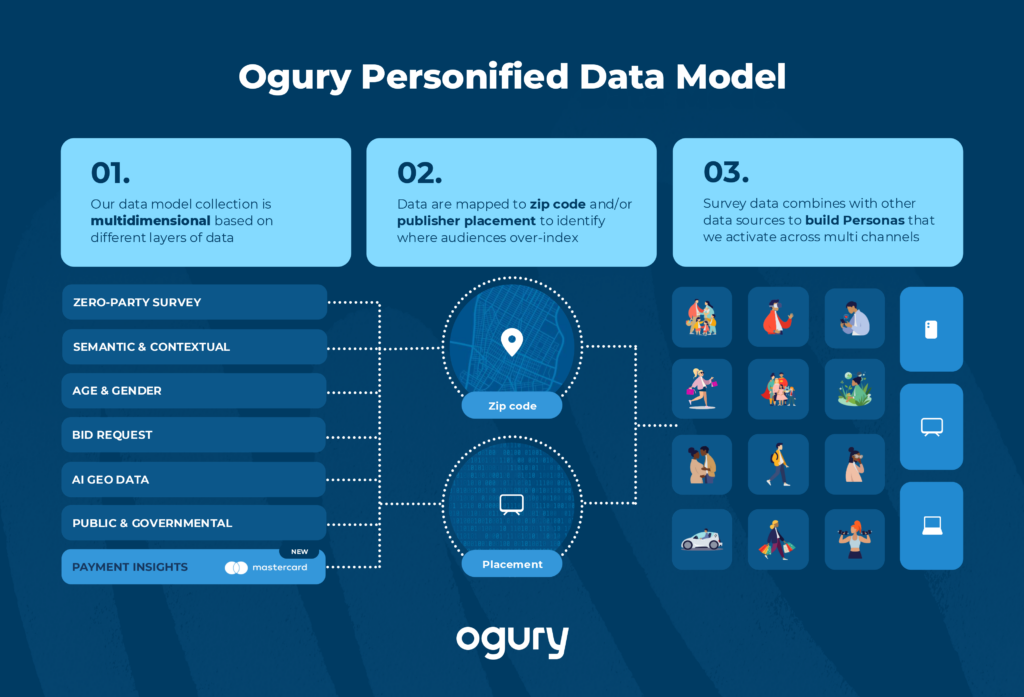

A Multidimensional Framework for Audience Targeting

Ogury’s persona-based technology brings together zero-party survey data and several complementary signals — including contextual and semantic data as well as real-time bid request data — all anchored to publisher environments and geographic areas such as ZIP codes, identifying where audiences with shared interests naturally converge.

This model is now enriched with aggregated and anonymized payment insights from Mastercard, adding deterministic and offline signals that complement Ogury’s declarative and online insights. Built through geographic segmentation, these insights identify areas with higher-than-average spend across key categories (e.g. Luxury, Retail, Travel), highlighting micro-geographies with concentrated or frequent spenders for these products or services. In doing so, they capture a wide range of real purchasing patterns across industries, anchored in real-world consumer behaviors.

Where Online and Offline Insights Come Together

Combining online signals with offline spend insights strengthens the precision and reliability of persona-based activation in a responsible way.

Since Mastercard’s insights are built on anonymized data and Ogury’s model doesn’t rely on personal identifiers, advertisers operate on a more privacy-forward foundation for audience activation. The payoff isn’t just improved precision, but the ability to uncover new audiences based on aggregated spending behaviors.

This approach is particularly valuable in environments such as connected TV, where audience signals are structurally limited. Using transaction-based insights to qualify ZIP codes helps inform activation in CTV environments typically consumed in those areas, supporting more relevant reach without inferring individual viewing behavior.

Personas Grounded in Real-World Behavior

Brought together, Mastercard’s insights and Ogury’s exclusive data sharpen persona definition and activation across screens and channels:

- Affluent Buyers informed by luxury spend insights across different product categories.

- Apparel Shoppers differentiated by gender and preferences, from affordable fashion to premium fashion segments.

- Tech Enthusiasts refined using electronics and computer hardware spend insights.

Mastercard’s audience insights are now available across most major Ogury markets globally, including the US, Canada, Australia, Singapore, Japan, the UK, Germany, Italy, Spain, Denmark, Finland, and Norway, with an aim to expand to additional markets.

With Ogury’s persona-based advertising, now enriched by Mastercard insights, advertisers can uncover new audiences, extend reach across environments such as connected TV, and drive growth — all without compromising consumer trust.

Ready to apply payment insights across your media strategy? Let’s connect.

- eMarketer – US Consumer Attitudes in Advertising & Privacy – July 2024 ↩︎

- Gracenote Global Video Data – August 2025 ↩︎

Subscribe to

The Ogury Outlook

Get expert insights, industry news, events and actionable tips.

One email weekly, direct to your inbox.