The New Codes of Desire: What U.S. Luxury Consumers Really Want In 2025

Luxury is being redefined. After years of steady growth, the market shrank in 2024, with 50 million consumers stepping away amid rising costs and economic uncertainty. For brands, relying on price hikes is no longer sustainable — desirability must be rebuilt.

To uncover what truly drives luxury purchases today, Ogury surveyed over 7,500 consumers — including 2,224 in the U.S. — to offer a detailed view into how perceptions of luxury are changing and what now drives desirability.

While this analysis focuses on U.S. luxury consumers, similar debates are unfolding across other major luxury markets, including Europe and Japan, where perceptions of value, meaning, and desirability are also being reassessed.

Against this backdrop, the survey findings reveal four powerful shifts reshaping the meaning of luxury.

Value Under Pressure: Why Price Alone No Longer Sells Luxury

- Nearly 40% of U.S. consumers scrutinize luxury purchases more closely.

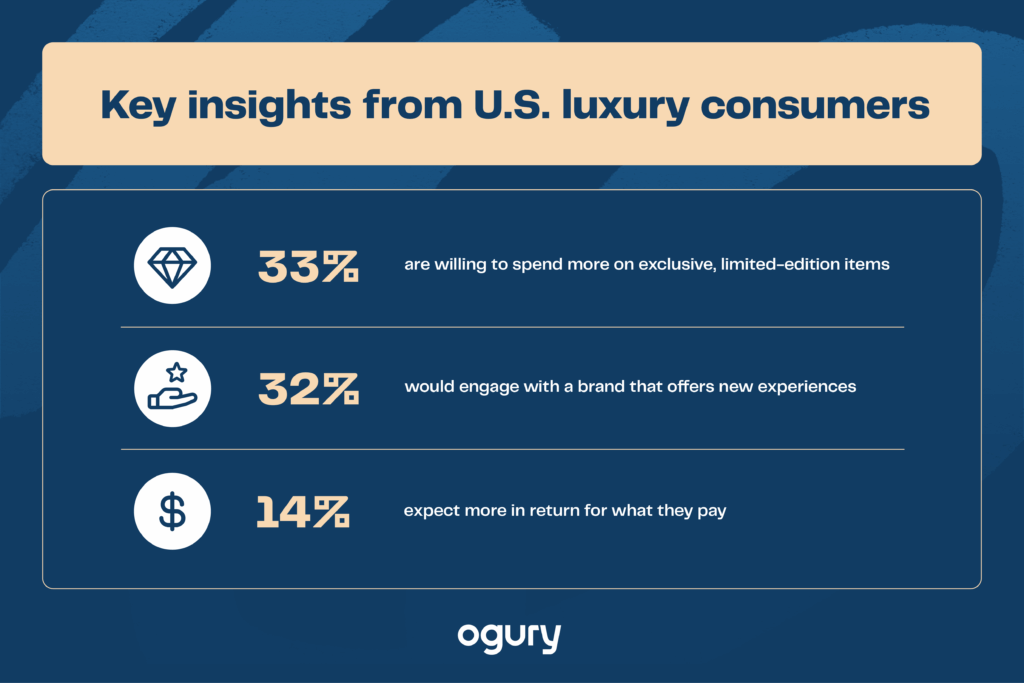

- 25% say goods are overpriced, while 14% expect more in return for what they spend.

In short, consumers are less willing to accept luxury at face value. Instead of equating a high price with desirability, they expect clear justification for what they spend. Brands must communicate value through quality, service, and storytelling, rather than relying solely on a premium price tag.

The Power of Uniqueness: From Prestige to Personal Expression

- 30% of U.S. consumers are swayed by the appeal of something unique.

- 1 in 3 would pay more for exclusives or limited editions.

The era of luxury as a universal status symbol is waning. Today’s consumers seek pieces that reflect their individuality rather than someone else’s badge of success. This puts personalization and scarcity at the heart of desirability. Campaigns that highlight bespoke options, rare drops, or co-created designs will resonate with buyers seeking products that tell their own story.

Experience Is the New Luxury: Living, Not Owning

- 32% of U.S. consumers want brands to offer them something they’ve never experienced before.

- 36% justify higher spend through heritage, while 34% value timeless design.

Luxury is no longer defined by accumulation. Consumers place greater importance on how a brand fits into their lifestyle and the experiences it unlocks. Yet heritage and timeless design remain powerful anchors, providing reassurance in an uncertain world. The opportunity for brands lies in marrying these two drivers — offering unique lifestyle experiences while drawing strength from their history and tradition.

Gifting Goes Mainstream: Celebration as a Growth Engine

- 52% of luxury purchases are gifts.

- Self-gifting is on the rise, with nearly 1 in 5 consumers celebrating themselves.

Luxury continues to play a central role in marking milestones. For gifters, it’s about choosing items that feel truly special for someone else, while self-gifters increasingly turn to luxury as a reward. Successful brand strategies must distinguish between the two, offering tailored services to enhance the emotional impact of each purchase.

The ground has shifted beneath luxury brands, and past formulas will no longer suffice. In a sector powered by desire rather than necessity, success will belong to the brands that understand what luxury means to consumers today. Those that combine personalization, experience, and emotional storytelling won’t just adapt — they will set the standard for the next era of cultural desire.

At Ogury, we help brands understand and activate these new codes of luxury through privacy-first insights. Ready to connect with today’s consumers? Get in touch with our team at hello@ogury.co.

Methodology

Ogury’s luxury market research is based on large-scale surveys conducted across the United States, Japan and Italy. The survey yielded 7,561 responses to provide a robust dataset and comprehensive evidence base for the analysis.

Ogury’s surveys are designed to collect zero-party data—highly accurate information that consumers willingly share about their behaviors, preferences, and purchase intent. Because the insights come directly from the individuals themselves, rather than inferred signals, they offer a unique, accurate, and privacy-safe view of audience motivations.

Subscribe to

The Ogury Outlook

Get expert insights, industry news, events and actionable tips.

One email weekly, direct to your inbox.